In today’s digital-first world, businesses and financial institutions are rapidly evolving to offer seamless, user-friendly services. However, with this shift comes an increase in fraudulent activities. To combat identity theft, money laundering, and other malicious attempts, businesses must adopt stronger Know Your Customer (KYC) verification services that include cutting-edge liveness checks. These technologies work in tandem to provide a secure and efficient onboarding process, ensuring that only legitimate users gain access to sensitive platforms.

What is KYC Verification?

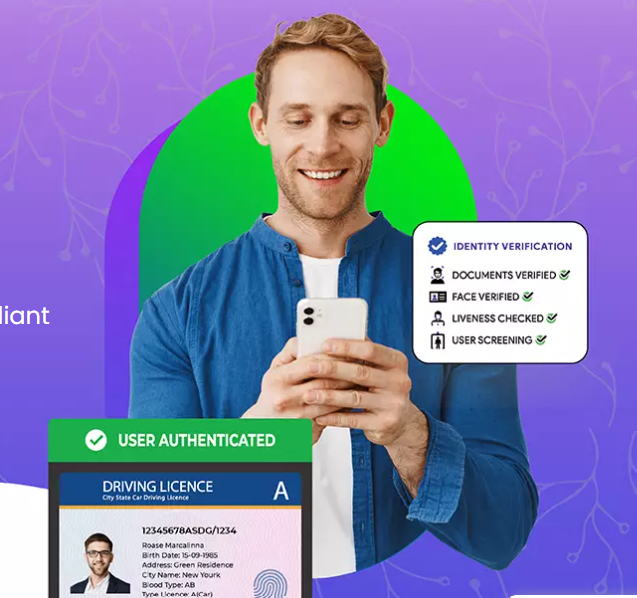

KYC verification is the process of confirming the identity of a person or entity before granting access to services. It is a critical step in preventing fraud, ensuring regulatory compliance, and building trust with customers.

Most industries such as banking, telecommunications, and even e-commerce, require robust KYC procedures. This typically involves gathering documents like a passport, driver’s license, or government-issued IDs, followed by verifying the identity using advanced technologies. While KYC verification has been around for years, the rise of digital transformation has made it more crucial to incorporate real-time checks like liveness detection.

Understanding Liveness Checks: The Future of Digital Security

A liveness check is a biometric verification process that confirms if the person being identified is physically present in front of the camera and not an image, video, or other digital spoofing attempts. It ensures that the facial recognition or identity authentication systems aren’t tricked by photographs, pre-recorded videos, or deepfakes.

There are two main types of liveness detection:

1. Active Liveness Detection

In this method, users are asked to perform certain actions, such as blinking, smiling, or turning their head. This movement is captured in real-time to ensure that the person is indeed live and not just a static image.

2. Passive Liveness Detection

Unlike active detection, passive liveness detection requires no user interaction. It analyzes the facial data captured by the camera to determine whether the subject is real or a spoof. This method is less intrusive and more user-friendly, making it ideal for seamless verification.

Why Liveness Checks Matter in KYC Verification

Combining liveness checks with KYC verification adds an extra layer of security to the onboarding process. Here’s how:

1. Prevention of Identity Fraud

Fraudsters often use stolen or fabricated identities to gain access to financial systems. By incorporating liveness detection, businesses can ensure that only real individuals are verified, thus minimizing the risk of fraud.

2. Enhanced User Experience

While robust security is essential, convenience should never be compromised. Liveness detection provides a fast and smooth verification process without overwhelming users. Passive liveness detection, in particular, offers a frictionless experience as it operates in the background without requiring user input.

3. Regulatory Compliance

Industries like banking, healthcare, and insurance are subject to stringent regulations like AML (Anti-Money Laundering) and GDPR (General Data Protection Regulation). Liveness checks help meet these requirements by ensuring that businesses verify and authenticate customers accurately before granting access to sensitive data or services.

4. Cost-Efficiency

Implementing liveness checks reduces the need for manual review of documents, thus decreasing operational costs. Automated systems streamline the KYC process, allowing businesses to focus their resources on more critical tasks.

Use Cases of Liveness Checks in KYC Verification Services

Liveness checks are being widely adopted across various industries for secure and reliable KYC verification. Some notable use cases include:

1. Financial Institutions

Banks and fintech platforms use liveness detection to verify users during account creation, loan applications, and money transfers. This technology significantly reduces fraud in these sensitive operations.

2. E-Commerce and Online Retail

With the rise of online shopping, many e-commerce platforms are incorporating KYC verification services to authenticate high-value purchases, preventing the use of stolen identities for fraudulent transactions.

3. Telecommunications

Telecom companies use liveness checks to verify customers’ identities when issuing SIM cards or creating new accounts, ensuring that the right person is accessing the service.

4. Healthcare

Telemedicine platforms implement liveness detection during patient onboarding to verify their identity, ensuring that only the right individuals access confidential medical records and services.

Best Practices for Implementing Liveness Checks in KYC

While liveness checks are a powerful tool, they must be implemented correctly to achieve optimal results. Here are a few best practices:

- Choose the Right Solution Provider: Opt for a trusted service provider that offers high-quality, AI-driven liveness detection. Ensure that their technology complies with industry standards and regulations.

- Seamless Integration: The liveness check process should be integrated smoothly into your existing KYC verification system without causing delays or creating friction for users.

- Regular Updates and Audits: Technology evolves rapidly, and so do fraudulent techniques. Make sure to regularly update and audit your liveness detection system to stay ahead of potential threats.

- Prioritize User Experience: Always aim for a balance between security and convenience. Active detection may not be suitable for all users, so consider implementing passive liveness detection where applicable.

Conclusion

As digital fraud continues to grow, the need for advanced identity verification solutions becomes more pressing. Combining liveness checks with KYC verification service offers a robust, reliable, and user-friendly way to protect businesses and their customers. By preventing fraud, enhancing user experience, and ensuring regulatory compliance, liveness detection is essential for any organization that prioritizes digital security.

Whether you’re in banking, telecommunications, or e-commerce, it’s clear that implementing these technologies will give your business a competitive edge while safeguarding sensitive information. Don’t wait until it’s too late—integrate liveness checks into your KYC process today and secure your digital ecosystem.