Zinc is a versatile metal used in various industries, including construction, automotive, manufacturing, and electronics. Understanding the price trends of zinc is crucial for manufacturers, traders, and stakeholders in these sectors. This article provides a comprehensive analysis the zinc price chart, covering historical data, recent fluctuations, market dynamics, and future outlook.

Historical Price Trends

Early 2000s to 2010

From the early 2000s to 2010, the price of zinc exhibited significant fluctuations. Key factors influencing prices during this period included:

- Supply and Demand Dynamics: Global supply and demand for zinc significantly impacted prices. Factors such as industrial production, economic growth, and consumption trends played crucial roles.

- Raw Material Costs: The cost of raw materials, such as zinc ore, and energy used in the production process influenced zinc prices.

- Economic Conditions: Global economic conditions, including inflation rates, currency fluctuations, and trade policies, influenced zinc prices.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/zinc-price-trends/pricerequest

2010 to 2020

Between 2010 and 2020, zinc prices showed considerable volatility, generally stabilizing between $2,000 and $3,000 per metric ton. Key factors during this period included:

- Increased Demand: Growing demand from the construction, automotive, and electronics industries drove price trends.

- Technological Advancements: Improvements in production technologies and efficiencies helped stabilize prices.

- Environmental Factors: Regulations related to environmental protection and energy consumption impacted production costs and prices.

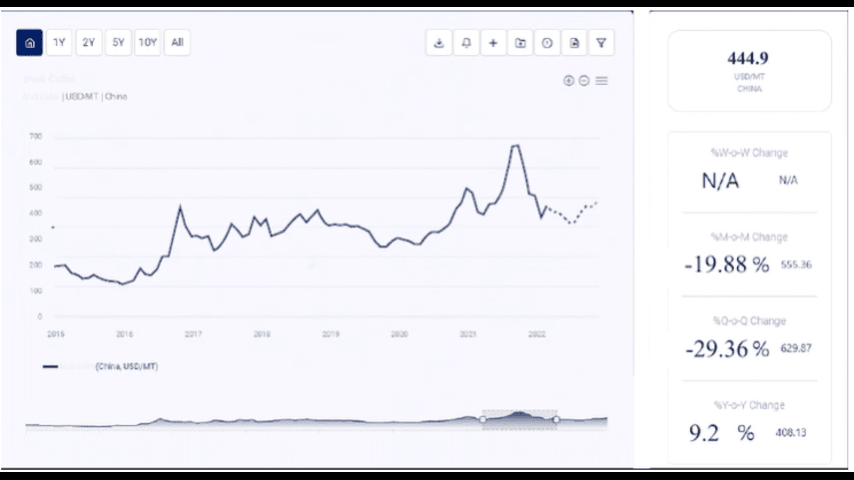

Recent Price Trends (2020-2023)

Impact of COVID-19

The COVID-19 pandemic had a significant impact on global markets, including zinc. In early 2020, prices fell due to reduced industrial activity, disruptions in supply chains, and decreased demand from key sectors. However, as economies began to recover and demand for construction and automotive products surged, zinc prices rebounded.

2021 to 2023

From 2021 onwards, zinc prices experienced significant fluctuations, influenced by the following factors:

- Supply Chain Disruptions: Continued disruptions in global supply chains, including logistical challenges and raw material shortages, led to price increases.

- Rising Production Costs: Increased costs of energy, transportation, and labor contributed to higher production costs, which were reflected in market prices.

- Environmental Regulations: Stricter environmental regulations in key markets, such as the European Union and China, drove demand for sustainably produced zinc.

- Economic Recovery: As economies recovered from the pandemic, increased industrial activity and consumer spending boosted demand for zinc.

Market Dynamics

Supply Factors

The supply of zinc is influenced by several key factors:

- Raw Material Availability: The availability and cost of raw materials like zinc ore and concentrates significantly impact production costs and supply levels.

- Production Capacity: The capacity of smelters and refineries to produce zinc affects supply. Investments in new plants or expansions of existing ones can increase supply.

- Geopolitical Stability: Political stability in regions producing key raw materials and zinc itself can affect supply chains and prices.

Demand Factors

Demand for zinc is driven by its applications in various sectors:

- Construction: Zinc is widely used in the construction industry for galvanizing steel to prevent corrosion.

- Automotive: It is used in the automotive industry for manufacturing vehicle parts and components.

- Manufacturing: Zinc is used in various manufacturing processes to produce machinery, equipment, and tools.

- Electronics: Zinc is used in the electronics industry for making batteries, particularly zinc-carbon and zinc-air batteries.

Technological Advancements

Technological advancements play a crucial role in shaping the zinc market:

- Production Efficiency: Innovations in production technologies, such as advanced smelting techniques and energy-efficient processes, can improve efficiency, reduce waste, and lower production costs.

- Recycling: Advances in zinc recycling technologies can supplement primary supply and reduce the environmental impact of zinc production.

- Product Development: Development of new alloys and applications for zinc can expand market demand.

Environmental and Regulatory Impact

Environmental and regulatory factors significantly influence the zinc market:

- Sustainability Initiatives: Increasing focus on sustainability and environmental protection has led to greater demand for responsibly produced zinc.

- Regulatory Compliance: Compliance with environmental regulations and standards, such as those set by the International Organization for Standardization (ISO) and national environmental agencies, impacts production practices and costs.

- Carbon Footprint: Efforts to reduce the carbon footprint of zinc production, including the use of renewable energy and carbon capture technologies, are becoming increasingly important.

Future Outlook

The future outlook for zinc prices is influenced by several factors:

- Technological Innovations: Continued advancements in production and recycling technologies and new applications will drive market growth and impact pricing.

- Global Economic Conditions: Economic recovery and growth, especially in developing markets, will drive demand for zinc in various industrial applications.

- Environmental Regulations: Stricter environmental regulations and sustainability initiatives will promote the use of responsibly produced zinc.

- Raw Material Supply: Ensuring a stable supply of key raw materials like zinc ore and concentrates will be crucial for maintaining stable production costs and pricing.

Regional Analysis

North America

North America is a significant market for zinc, driven by robust demand from the construction and automotive sectors. The United States and Canada are major producers of zinc, with significant mining operations. Trade policies, economic conditions, and environmental regulations play crucial roles in shaping the zinc market in this region.

Europe

Europe’s zinc market is characterized by stringent environmental regulations and a strong emphasis on sustainability. The European Union’s focus on reducing carbon emissions has led to increased demand for recycled zinc and investment in green technologies. The construction and automotive industries remain major drivers of zinc demand in Europe.

Asia-Pacific

The Asia-Pacific region, led by China, is the largest producer and consumer of zinc. Rapid industrialization, urbanization, and infrastructure development have fueled the demand for zinc in construction, transportation, and manufacturing sectors. China’s dominance in zinc production and its policies on export and environmental regulations significantly influence global zinc prices.

Latin America

Latin America has emerged as a growing market for zinc, with Peru and Mexico being key players in zinc production. The region’s abundant raw material reserves and increasing investments in mining infrastructure contribute to the growth of the zinc market. The construction and manufacturing industries drive the demand for zinc in this region.

Middle East and Africa

The Middle East and Africa region is witnessing growth in zinc consumption, supported by investments in construction and industrial projects. South Africa and Namibia are major producers of zinc in this region. The region’s focus on economic diversification and infrastructure development will drive demand for zinc, while environmental regulations and sustainability initiatives will shape future trends.

Investment Opportunities

Investing in the zinc market offers several opportunities for growth and returns:

- Recycling and Sustainability: With increasing focus on sustainability, investments in zinc recycling technologies and facilities offer promising returns. The demand for recycled zinc is expected to grow, driven by environmental regulations and consumer preference for eco-friendly products.

- Technological Advancements: Investing in companies that are pioneering advanced production technologies and efficiency improvements can provide competitive advantages and cost savings.

- Emerging Markets: The rapid industrialization and urbanization in emerging markets, particularly in Asia-Pacific, present significant opportunities for investment in zinc production and downstream applications.

Conclusion

The zinc market is characterized by its sensitivity to various economic, environmental, and regulatory factors. Understanding the historical and recent price trends, along with the underlying market dynamics, is crucial for stakeholders to navigate this complex landscape. As technological advancements and sustainability initiatives continue to evolve, the zinc market will face new opportunities and challenges. By staying informed and adapting to these changes, manufacturers, traders, and policymakers can better manage the impacts of fluctuating zinc prices. The regional analysis and competitive landscape provide insights into the key drivers and players in the zinc market, highlighting investment opportunities for growth and returns.